Hot market woes:

Tactics in place to deter buyers from flipping (Seattle Times)

Finding an apartment is harder — and pricier (Seattle Times)

If flippers can still flip then people must be willing to pay for flipped properties and if it is getting harder to find rentals, then it is still paying off for those apartment-to-condo conversions.

Or is it?

Could it also be that builders are trying to discourage flipping because it is getting harder to sell their inventory? If everything sold, it wouldn’t really matter if there was some flips, would it? Could it also be a sign that the flipping exuberance is getting a little over the top? The final death throes? Could it be harder to find a rental because the housing market is pricing out many more people and it no longer makes any economic sense to buy?

Can Seattle justify it’s housing costs?

When you think of crazy housing costs, you think of New York City, San Francisco, London, Paris, Tokyo and other World Class Cities. Can Seattle justify itself cost-of-living-wise in regards to the other cities? The Seattle Bubble blog doesn’t think so, the Seattle PI doesn’t think so, and neither do I. Having grown up in an alpha world city (Chicago) and lived in a beta world city (San Francisco), I can say that Seattle is not a world city. (Wikipedia page on world cities) Seattle has always struck me as a cross between Pittsburgh (where I went to college) and San Francisco (where I lived right after college). Like Pittsburgh, it is a relatively small town with distinctive neighborhoods separated by geography. Also like Pittsburgh, it is a company town (Microsoft and Boeing vs. PPG and Heinz). Seattle reminds me of San Francisco because of its proximity to nature, location on the water, vistas and large percentage of urban hipsters.

To my mind, it is that company-town thing that most disqualifies Seattle as a world-class city. I can’t swing a cat without hitting a current or former Microsoft or Boeing employee. These companies constantly come up in conversation with any other local. A world-class city is diverse. Seattle is not diverse, and with its current housing prices, it is becoming less diverse over time.

Speaking of jobs

I came across the Seattle Bubble blog this morning. Very cool. On there I found a post from last year that I still find relevant: Let’s Talk Jobs. This post reiterates some of the things that I have been saying and makes some new points as well. We, in Seattle, are constantly told that because the economy is growing and jobs are being created that the we aren’t in a bubble and we shouldn’t expect prices to stop growing EVER.

This, of course, makes absolutely no sense.

The era of the Microsoft millionaires paying extravagant prices of property is over: MS has moved from options to grants (dropping the number of shares granted drastically in the process), MSFT has been flat for seven years (and Vista didn’t help), and they company is capping raises BELOW the cost of living increases from year to year. Microsoft continues to hire into the region, but in much lower amounts than in previous years. Most of Microsoft’s growth is now overseas.

Most of the new jobs being created in the region are IN REAL ESTATE. We are becoming a region whose business it is to make houses to sell to each other, or to refurb and flip existing houses. That is simply and obviously unsustainable.

Will you ever be able to buy a house?

Priced out Forever attacks this fallacy on a national scale.

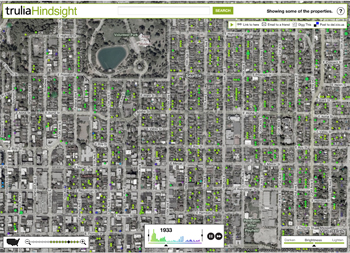

Trulia hindsight

Trulia hindsight

The Geography of Nowhere (The Rise and Decline of America’s Man-Made Landscape), by James Howard Kunstler

The Geography of Nowhere (The Rise and Decline of America’s Man-Made Landscape), by James Howard Kunstler